Cryptocurrency exchanges have become a crucial component of the digital asset ecosystem, providing individuals and institutional investors with platforms to buy, sell, and trade various cryptocurrencies. However, concerns over conflicts of interest within centralized cryptocurrency exchanges (CEX) have come to the forefront. Gary Gensler, the Chairman of the U.S. Securities and Exchange Commission (SEC), has recently raised these concerns and proposed solutions to address them. In this blog post, we will delve into Gensler's perspective on conflicts of interest, explore the potential benefits of decentralization, and discuss emerging concepts such as decentralized exchanges (DEX), perpetual trading, and the liquid staking ecosystem.

Gensler draws attention to the traditional financial system, which separates market-making, custody, clearing, and investments to mitigate conflicts of interest. This separation ensures that one entity does not have undue control over multiple aspects of the trading process. In contrast, many centralized exchanges in the cryptocurrency space combine these functions, potentially creating conflicts of interest that could undermine market integrity and investor trust. Gensler suggests that adopting a similar approach to the financial sector, with a clear separation of activities, could address these concerns.

We believe that decentralizing trading is the way forward for the cryptocurrency industry. By eliminating centralized intermediaries and implementing decentralized exchanges (DEX), transparency and trust can be enhanced. DEX platforms allow users to trade directly with each other, eliminating the need for a central authority. This decentralized model reduces the risk of market manipulation and improves security. However, we would like to emphasize the importance of user-friendly interfaces and enhanced security measures to promote wider adoption and safeguard user assets still need to improve and further developed.

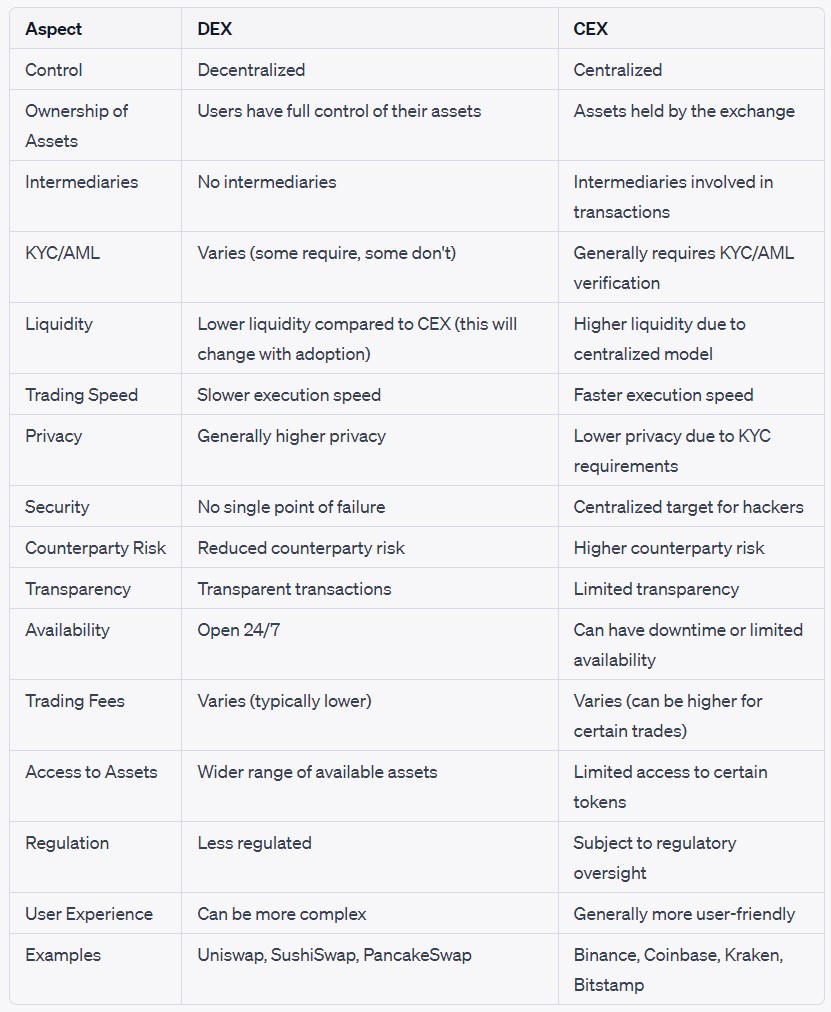

Table1: Comparison of the main characteristics of Decentralized Exchanges (DEX) vs. Centralized Exchanges (CEX)

Source: CCCapital, June 2023

The disappearance of centralized exchanges could have a bullish impact on the cryptocurrency sector. With the rise of decentralized trading, opportunities emerge for decentralized finance (DeFi) protocols and onboarding solutions in the Web3 ecosystem. We are interested in tokens that generate real yield from DEX and perpetual trading. The rise of these platforms could offer great investment opportunities and real income potential. Furthermore, we are interested in liquid staking protocols as centralized platforms will be limited to offer these services.

Projects like #gmx, #snx, #pendle, #lido, and #rocketpool are at the forefront of innovation in decentralized finance and represent promising opportunities within the cryptocurrency space. These protocols offer unique features and capabilities that align with the principles of decentralization and could contribute to the growth and maturation of the industry.

Gary Gensler's concerns regarding conflicts of interest in centralized cryptocurrency exchanges shed light on an important aspect of the digital asset ecosystem. Embracing decentralization and adopting decentralized trading platforms can help address these concerns while promoting transparency and enhancing user security. The emergence of decentralized finance protocols and concepts such as DEX, perpetual trading, and the liquid staking ecosystem further reinforces the potential for a more inclusive and decentralized future. As the cryptocurrency industry continues to evolve, it is crucial for market participants to navigate this changing landscape while adhering to regulatory frameworks and embracing technological advancements.

By Henry

Disclaimer: The mentioned protocols and concepts are for informational purposes only and do not constitute financial advice. Investors should conduct their own research and exercise caution before making any investment decisions in the cryptocurrency space.