Global liquidity is a crucial concept for investors as it measures the amount of money, funds, and credit flowing through world financial markets. It serves as the driving force behind the financial system.

Liquidity plays a significant role in both asset markets and the real economy. It cannot be in two places at once, so when money is in the real economy, it tends not to be in financial markets, and vice versa. Central banks and credit providers are responsible for initiating liquidity by pushing it through the financial system. This process first affects asset markets and then spills over into the real economy. It's important to note that strong economies don't always have strong financial markets, and weak economies don't always have weak financial markets. In the midst of a recession, financial markets tend to rise as the central banks inject liquidity into the system, even though the real economy experiences reduced money usage.

China's influence on global liquidity is indirect. The People's Bank of China, as the second most important central bank globally, mainly focuses on driving the Chinese real economy. Its impact on Chinese financial markets is less significant, but its influence on the global economy is substantial. China's massive economic and industrial footprint worldwide means that the stimulus from the central bank creates significant ripple effects in the global economy. In contrast, other central banks like the European Central Bank, the Bank of Japan, and the Bank of England tend to follow the lead of the Federal Reserve, as they aim to keep their currencies aligned with the U.S. dollar.

In addition to central banks, collateral plays a crucial role in liquidity creation. There are three primary inputs to the process: central bank actions, the euro dollar market (offshore deposits used for credit creation), and the pool of collateral worldwide. Collateral refers to the security or guarantee provided for lending purposes. Prior to the global financial crisis, most lending was uncollateralized, relying on trust between banks. However, collateralized lending, using assets like U.S. Treasury bonds or German bunds, has become increasingly important. The size and value of the collateral pool impact lenders' willingness to extend credit, with market volatility playing a significant role. Increased tension in bond markets reduces credit availability, as lenders impose higher haircuts on collateral. This aspect becomes especially relevant during periods of high bond market volatility, such as the recent negotiations surrounding the U.S. debt ceiling.

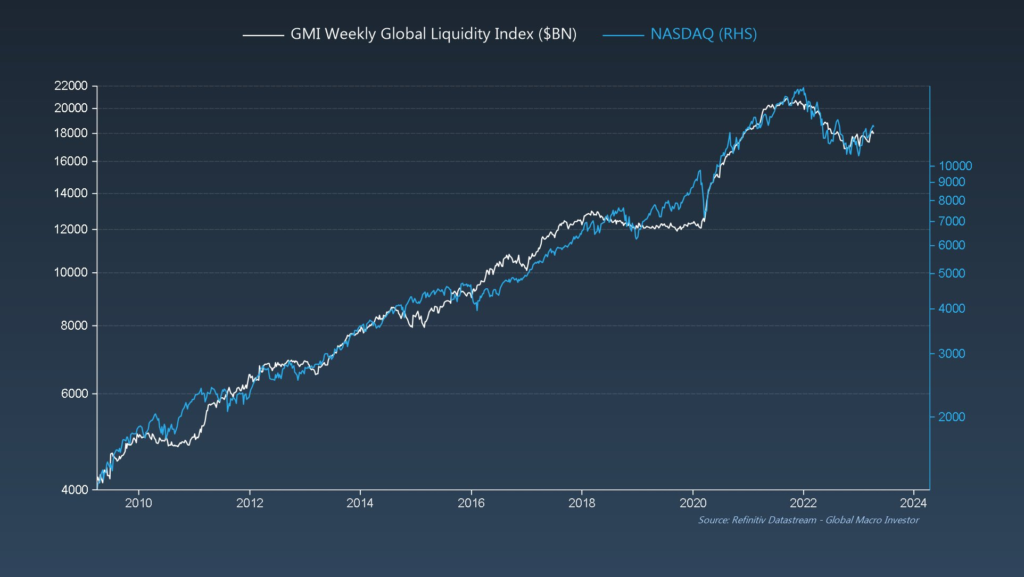

Graph courtesy of Global Macro Investor

When looking at the timing of global liquidity, there is a cyclical pattern. The current data suggests that we are at a trough in the global liquidity index, indicating a low point. Bank failures are often observed at this stage. However, central banks, particularly the Federal Reserve, are more proactive in the current situation compared to the global financial crisis of 2008. They have a better understanding of the necessary instruments to address liquidity issues. In recent months, a stealth quantitative easing (QE) has been occurring as money is injected into the system to improve liquidity. The Federal Reserve's preemptive actions aim to stabilize the banking systems and prevent widespread failures.

Looking ahead, it is estimated that it will take around three to four years to reach a higher point in the global liquidity index. The current situation calls for proactive measures from central banks to inject liquidity into the system and stabilize financial markets. This includes bailouts of the banking systems to prevent further failures. The actions taken by central banks and policy makers will shape the future landscape, with an emphasis on increasing liquidity through quantitative easing.