Since October 2022, public equity markets have experienced a strong rally. It might be one of the most hated rallies in history because underlying fundamentals indicate weakness and a possible upcoming recession. Many professional investors have been surprised by the strength of the market, while the earnings growth outlook has been meagre or negative. The valuation of the market, based on the P/E ratio, appears rich.

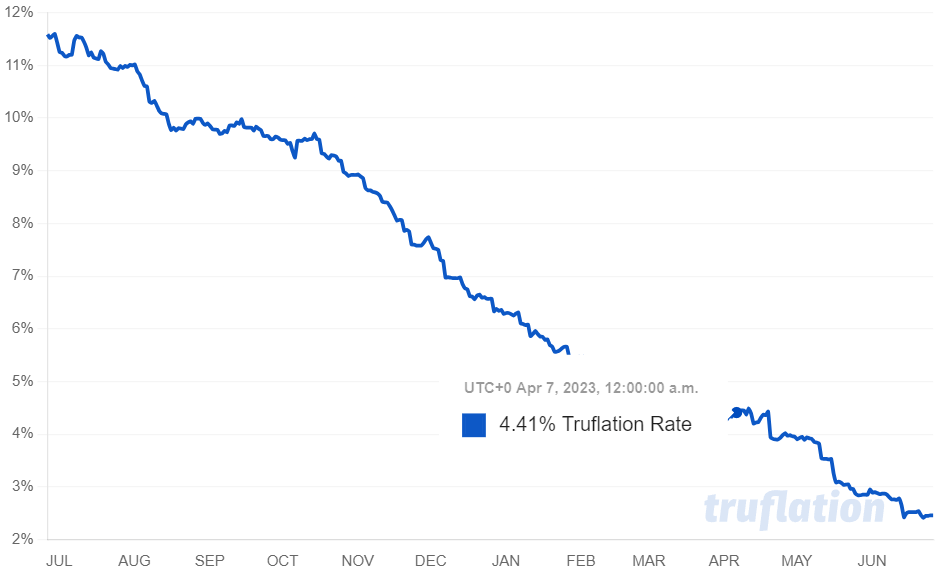

We became optimistic about equity and crypto because we believed that we were past peak inflation. Higher interest rates certainly had an impact on inflation momentum. Second, we believe that the post-COVID logistics problems were being resolved. Currently, we believe we are in a strong disinflation wave and at risk of deflation rather than inflation. Another important driver for us was liquidity. We observed liquidity bottoming out, and as we anticipated that liquidity would ease, we expected the market to no longer sell off aggressively. The Gilt crisis in the UK and the banking crisis in the US contributed to stealth quantitative easing (QE) and provided support to the market.

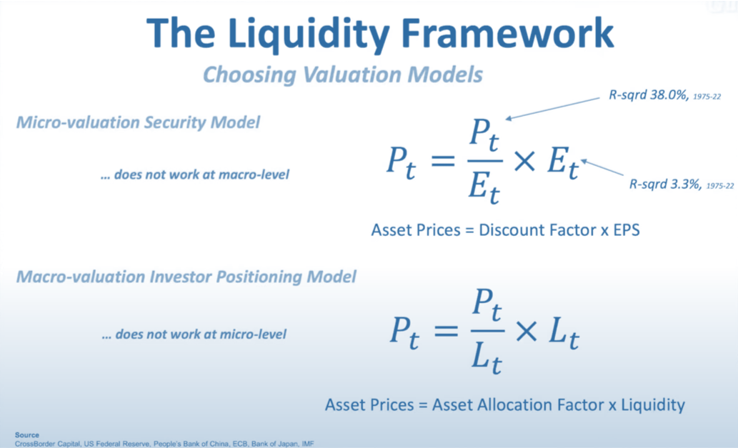

How does this work? The P/E multiple is a standard valuation tool for assessing asset markets. Most forecasters focus only on earnings (E) when considering this multiple. While the relative growth of earnings can be very supportive in indicating alpha from a bottom-up perspective, we believe it is equally or more important from a top-down perspective to analyze what drives the multiple itself.

According to Michael Howell from CrossBorder Capital, the multiple is driven by inflation and liquidity. As investors, we need to understand what drives the direction of the market in order to make informed allocations. Within the allocation, we need to select those companies that drive alpha. Since the global financial crisis, central banks and liquidity have had a significant impact on financial markets. Relying solely on a mean reversion P/E strategy to determine whether markets are expensive or cheap might no longer work as long as the liquidity impact remains present.

We think that central bank actions and cross-border money flows play a role in driving asset pricing. Adding a liquidity perspective to your top-down investment process will help investors better understand market direction, even when fundamentals indicate a contrasting picture. How can investors approach this? Michael Howell provides some directions:

• Central bank policies: Monitoring the actions of key central banks, such as the Federal Reserve and the People's Bank of China, is essential. Unconventional policies like quantitative easing, yield curve control, and bond buybacks can impact liquidity and reduce market volatility.

• Government debt and QE: Anticipating increased debt issuance by governments, which may lead to central banks like the Federal Reserve engaging in quantitative easing (QE) to buy a significant share of that debt. Understanding the impact of QE on asset prices is important for investors.

• Correlation between liquidity and the US dollar: Recognizing the correlation between global liquidity and the US dollar component as a predictor of liquidity and its impact on risk assets. Analyzing this relationship can provide insights into market trends.

• Economic cycle and interest rates: Assessing the economic cycle and interest rate expectations. Differentiating between cost deflation and monetary inflation and considering the potential impacts on asset allocation. Predicting turning points in the economic cycle can be valuable for investment decisions.

• Bond market dynamics: Staying informed about the dynamics of the bond market, including yield curves, term premiums, and supply and demand for treasuries. Distortions in the bond market can affect liquidity and impact investment strategies.

• Equity market and inflation: Recognizing the relationship between inflation and equity markets. A moderate level of inflation (around two percent) may positively impact equity valuations, while negative inflation can lead to market derating. Monitoring inflation data and its potential influence on asset prices is important.

• China's role in the global economy: Understanding the impact of China's liquidity cycle on the global economy. China's monetary policies, liquidity injections, and infrastructure spending can have significant implications for various markets and investment opportunities.

• Financial stability and crisis prevention: Recognizing the role of central banks in maintaining financial stability by supplying liquidity. Central banks can help avoid financial crises by addressing liquidity needs in the financial system.

• Zone-based investment strategies: Considering investment strategies based on the liquidity-investment matrix. Strategies such as credit arbitrage may be suitable in certain liquidity environments, while volatility-based strategies may be less favorable.

These perspectives highlight the importance of monitoring liquidity, understanding central bank actions, and anticipating the impacts of fiscal and monetary policies on various asset classes. Investors should stay informed about global liquidity trends, economic cycles, and market dynamics to make informed investment decisions.

For a detailed "teach-in," we recommend watching this valuable YouTube video https://youtu.be/xvAaAllnFzk