The debate about listed versus private assets and the pro’s and con’s of each asset class is probably almost as old as the assets themselves. With the recent change in economic and monetary climate, this debate entered a new round that has to play out over the coming years. IN this piece, we do not want to rehash all the well-known arguments, but rather shed light on the current state and the need for more integration of the two.

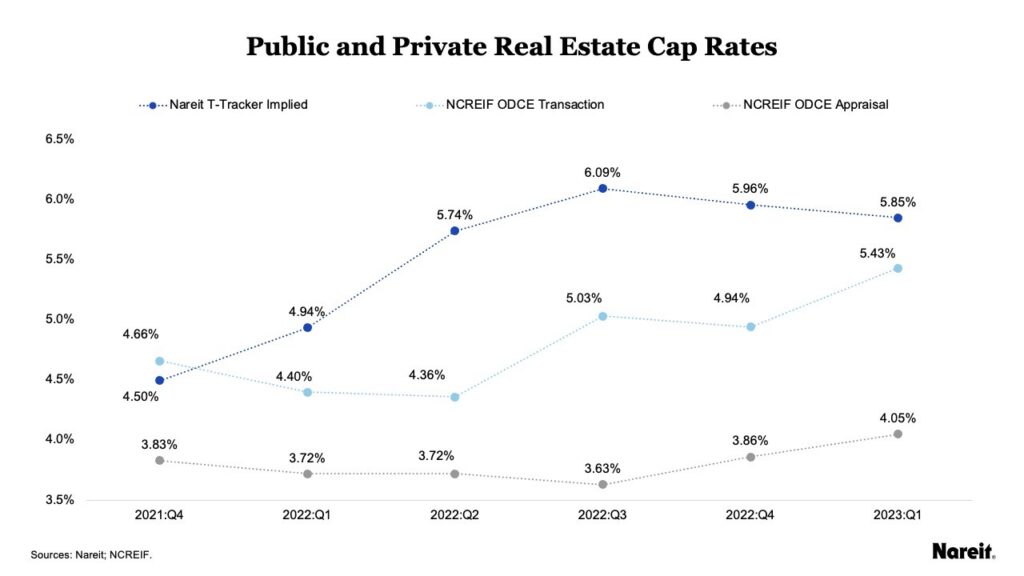

Edward F. Pierzak, recently unveiled a series of fascinating charts on reit.com, shedding light on contrasting cap rates in private real estate versus public real estate. These charts specifically highlighted the divergence in cap rates between the two markets throughout 2022, offering valuable insights into the shifting dynamics of the economic and financial environment.

The swift interest rate hikes implemented by the Federal Reserve had an immediate impact on the valuations of public REITs, triggering a rapid sell-off in the market. Within a span of just three quarters, this tumultuous environment led to a staggering 150 basis points increase in implied cap rates. It was a rational response to the changing economic and financial conditions, as heightened volatility often results in overcorrections. Nonetheless, astute investors will recognize this as an excellent opportunity, as the market worked to establish a new equilibrium.

While public markets were quick to adapt to these fluctuations, private markets exhibited a more measured response. Since then, the valuation gap between implied cap rates of public and private real estate gradually narrowed. This situation presented an intriguing prospect for investors, as the disparity offered an entry point into public real estate at potentially advantageous prices. Notably, the NCREIF ODCE Transaction cap rates gap is closing after five quarters. However, an examination of the NCREIF ODCE Appraisal cap rate data suggested that further write-downs could be anticipated for a more accurate pricing assessment. Considering that ODCE data primarily encompasses Open-End Core funds, it is plausible that the appraised value gap might be even wider for closed private funds. Consequently, open-end funds offering liquidity presented an enticing arbitrage opportunity, while liquidity for closed-end funds could pose a greater challenge. However, with every market crisis we realize that open-end funds could struggle to remain open. It is worth mentioning that the quest for liquidity in private investments contradicts the inherent nature of such investments, as high liquidity would essentially transform a private vehicle into a public one. Therefore, the combination of liquidity and private investments might be a strange concept.

Investing in private or public real estate offers a multitude of reasons to consider, but in the context of larger institutional portfolios, we believe that these markets are complementary. In the long run correlation between these different markets is high, but in the short run the differences between public and private offer great arbitrage benefits. Data consistently demonstrates a clear arbitrage opportunity between the two, emphasizing the importance of integrating valuation, liquidity requirements, and expected total returns into the allocation decision-making process. Unfortunately, many institutional investors solely focused on private investments often overlook the significant opportunities that arise from integrating these two complementary strategies. Extensive research has demonstrated that a balanced portfolio incorporating both public and private real estate strategies deliver a more efficient real estate portfolio.

It is imperative that every institutional investor recognizes the importance of having a dedicated public real estate team. By incorporating expertise in both private and public markets, institutions can leverage the unique advantages offered by each segment, ensuring a well-rounded and diversified approach to real estate investing. Thoroughly discussing every real estate investment opportunity in terms of its suitability for both public and private markets. By actively considering alternatives, valuation and evaluating the potential benefits and drawbacks of each avenue, institutional investors can make informed decisions that maximize their chances of success.

In an ever-evolving and complex investment landscape, the integration of private and public real estate strategies is a crucial step towards achieving superior risk-adjusted returns. As the market dynamics continue to shift and opportunities arise, institutions that embrace this holistic approach will be best positioned to navigate the challenges and capitalize on the full spectrum of possibilities within the real estate sector.