Caution: Post may contain contrarian opinions.

Central banks worldwide have taken a proactive stance, raising interest rates aggressively to combat the recent rapid surge in inflation. However, comprehending the complexities of inflation remains challenging, and central banks and economist struggle to understand it. In light of the post-Covid recovery and the Ukraine conflict, inflation spiked rapidly. Now a closer examination of leading indicators suggests a growing momentum towards disinflation. As market participants debate the sustainability of inflation, we maintain a positive stance on equity markets since the peak of inflation in the US. Further disinflationary pressures could support equities throughout the year driving price-to-earnings (P/E) expansion.

To illustrate the varying outlooks presented by Western central banks, we present a selection of charts that highlight the divergent perspectives:

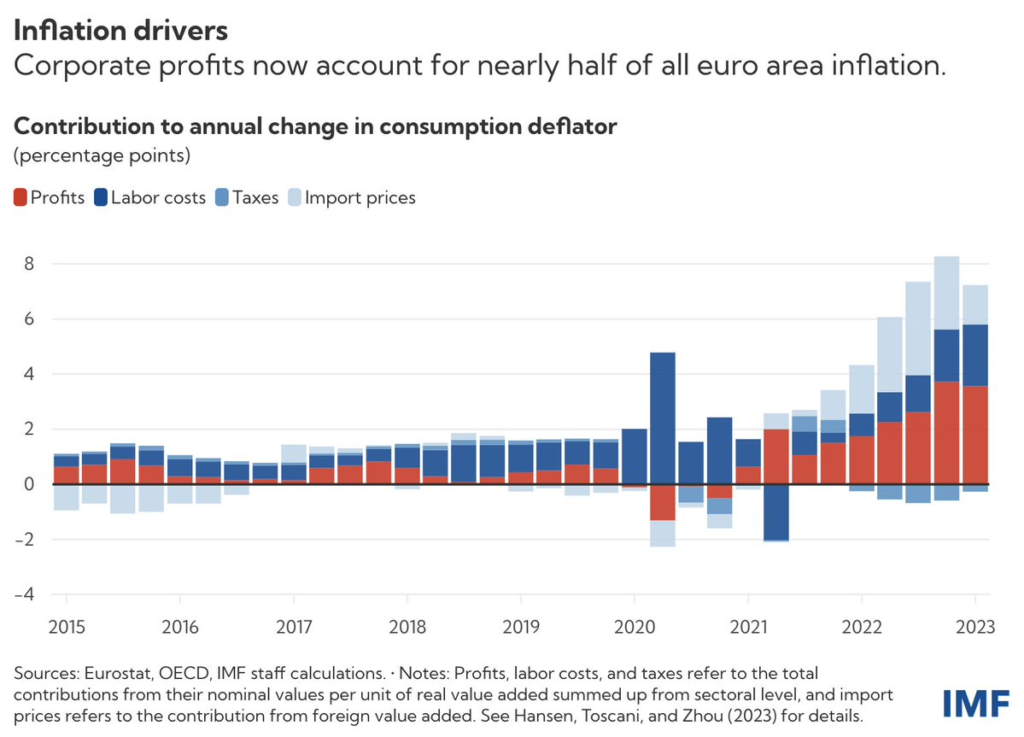

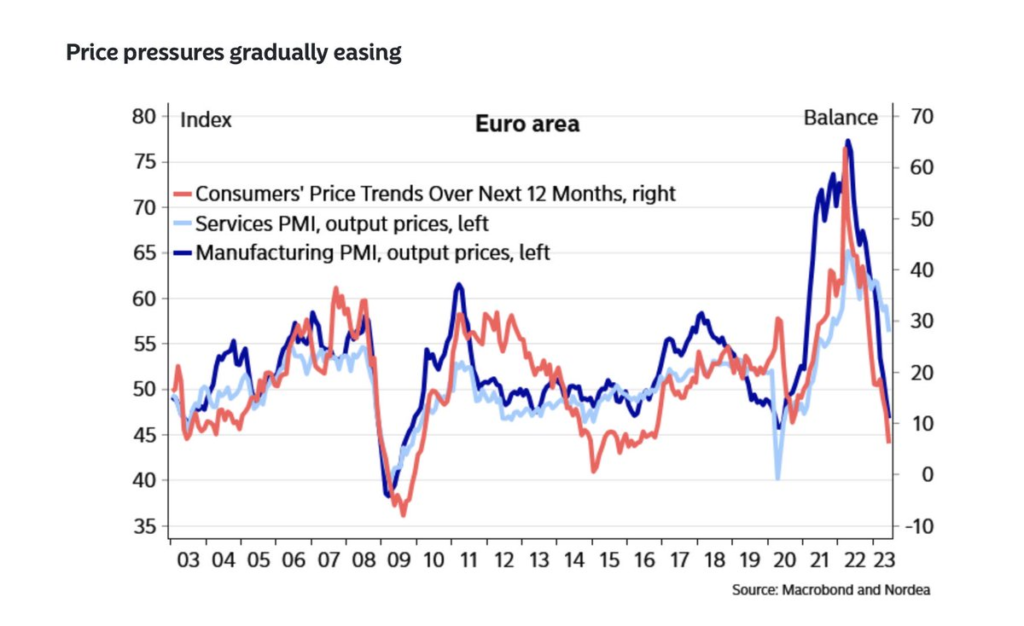

The IMF chart reveals an intriguing correlation between inflation and high profits in the Euro area. We posit that elevated prices inevitably lead to reduced demand, thereby exerting downward pressure on prices. Consequently, profit margins could face increasing strain due to higher inventories, while supply chains are normalizing, thereby further contributing to price moderation. Concerns persist regarding potential secondary inflation stemming from low unemployment, we believe that higher wages may ultimately result in increased joblessness.

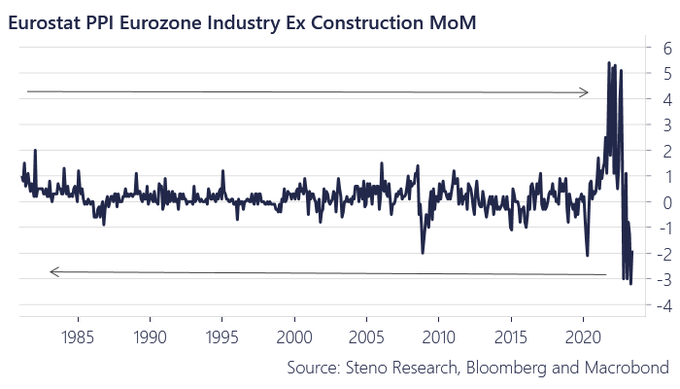

The collapse of the Producer Price Index (PPI) in Europe is a significant development that will likely impact headline inflation in the near future. Central Banks initially underestimated the inflationary risks, and made a delayed shift in policy when a series of aggressive rate hikes followed. However, recent indications suggest a swift momentum shift, making the current hawkish stance increasingly incongruent with evolving market conditions.

While the momentum towards disinflation appears strong, it is crucial to consider potential inflation risks and catalysts for deflation. We see a few inflation risks. Among these risks are higher wages, an increase taxes, and rapid ESG policy.

One catalyst for more disinflation is the weaker economic outlook partly the result of the constraint liquidity by central banks.

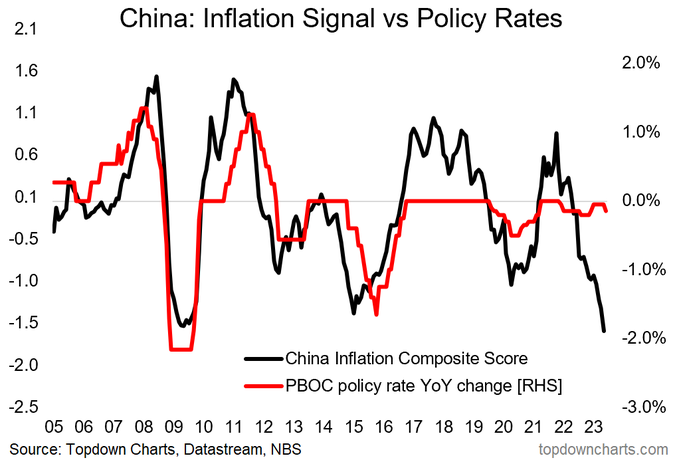

A second disinflation worry is linked to China, a subject we explored in a previous article titled "Will China save or sink the world economy?".

Throughout this year, equity markets have thrived, demonstrating their resilience to the high interest rates. Interestingly, bond markets appear to hold different expectations, as they have not yet reflected the current disinflationary trend. Given the continuation of disinflation, we contend that bond yields are currently overstated. In contrast, equity markets have already priced in the ongoing disinflationary environment.

These perspectives influence our outlook on different fronts of our framework

Inflation

The outlook for inflation confirms a shift towards disinflationary trends, providing a favourable backdrop for equities. As disinflation continues, we believe bond yields are currently excessively elevated.

Liquidity Outlook

Liquidity conditions have likely bottomed, contributing to a supportive environment for equity markets.

Macroeconomic Cycle

The overall economic strength introduces the highest level of uncertainty. A weaker economy looks a certainty but at the same time real weakness seems to be postponed. The central banks' potential future pivot could trigger a significant price correction of the equity market, resulting in a substantial market event.

Central banks' battle against inflation continues to evolve, with the focus shifting towards potential deflationary pressures. While equity markets have responded positively to the current disinflationary environment, bond markets have yet to fully adjust their expectations. As we consider inflation outlook, liquidity conditions, and the macroeconomic cycle, we anticipate that a pivot by central banks due to robust economic conditions could lead to a notable market sell-off. Thus, market participants should closely monitor evolving inflation dynamics and central bank policies to navigate these uncertain times effectively.