Following the reopening of the Chinese economy after stringent COVID-19 measures, initial hopes were high for China to bolster the global economy. However, the economic revival experienced thus far has been relatively modest, failing to gain strong momentum. China's past crackdown on the tech and real estate sectors, coupled with recent stimulus measures, has left many liquidity-focused investors eagerly awaiting further Chinese stimulus to support economic recovery.

One of the fundamental challenges faced by China's economy is the transition from an investment-driven model to a consumption-driven model. This transformation is essential but comes with its own set of difficulties. The impact of this transition is being keenly felt by China as it grapples with various economic issues. The real estate market continues to face problems, and the economy is burdened by a significant debt load and a slowdown in exports. Furthermore, there is a tangible risk of deflation, which compounds the existing challenges. The Chinese authorities must navigate this painful journey of transitioning the economy while mitigating the adverse effects.

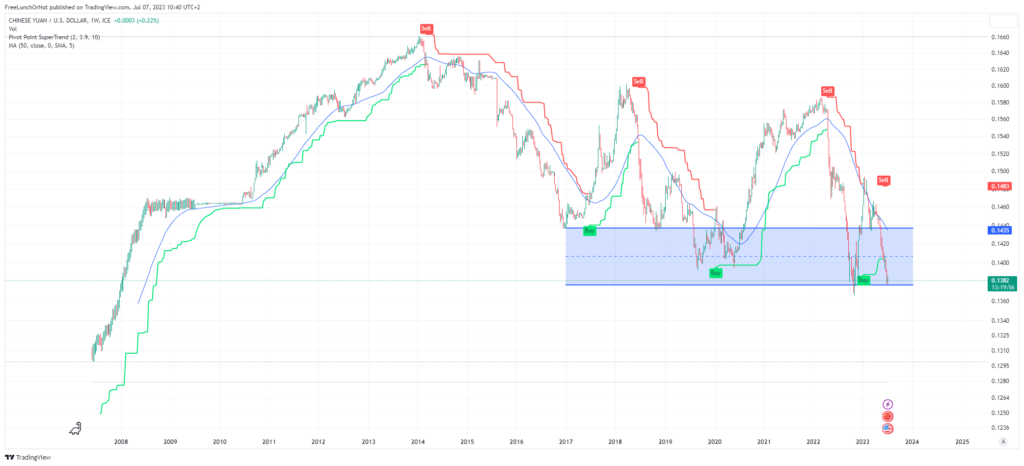

To alleviate the economic strain, there have been renewed calls to prop up the real estate market and increase infrastructure spending. Additional financial stimulus could provide much-needed support to the economy. However, this approach must be balanced with the potential repercussions. The weakness of the Chinese economy is evident in the exchange rate, particularly with the Renminbi showing significant weakness against the dollar. This development is of particular interest, as it approaches a critical range where the People's Bank of China (PoBC) may find it increasingly challenging to control the currency. The recent leadership shuffle within the PoBC further indicates that the authorities are grappling with the current situation.

While additional financial stimulus may weaken the currency further, a stronger focus on supporting the currency could result in increased dumping of US treasuries. This, in turn, could contribute to the elevated 10-year yield in the US. The Chinese authorities are acutely aware of the potential risks and are undoubtedly feeling the pressure. The restoration of confidence becomes crucial in providing support for the Renminbi. High expectations for financial stimulus may need to be tempered, necessitating market interventions and further reforms by the Chinese Communist Party (CCP) to stabilize the economy.

The repercussions of China's economic situation extend beyond its borders. The deflationary forces emanating from China are likely to impact the global economy, contributing to a disinflationary environment. While central banks in the West maintain a hawkish stance on inflation, the current market risks appear to be more deflationary in nature.

China's economic recovery post-COVID faces significant headwinds, necessitating a delicate balance between stimulating the economy, managing currency weakness, and implementing structural reforms. The transition to a consumption-driven economy is a challenging process, and the Chinese authorities must navigate through various obstacles, including the real estate market, mounting debt, and slowing exports. Confidence restoration and market stabilization are key priorities, both domestically and globally. By carefully addressing these challenges, China can contribute to a sustainable and resilient global economy.

We think investor should consider the following assumptions in their global macro views.

- China won’t bail out the global economy on with growth

- China might be an active seller of US treasuries to support the currency

- Chinese stimulus might be less aggressive due to the weak currency

- China is increasingly exporting deflation to the world

- The economic momentum of China might not support commodities

- Chinese real estate markets could receive some stimulus but won’t solve the structural economic problems.

- China will have to work on diplomatic ties to integrate the global economy to avoid the threat of reshoring.

In the meantime China has been reducing liquidity in an attempt to support the currency (more or less, cancelling the earlier stimulus). China will be prepared to weaken the currency but the PoBC wants to have control about the fixing. Stimulus likely will only follow once more control is established.