Nvidia's Stellar Earnings Reflect a Promising Future for AI and Cloud Computing

Nvidia's recent earnings report has set the stage for a promising future in the world of artificial intelligence (AI) and cloud computing. The company's robust performance suggests that AI's potential is not merely a passing trend, and the increasing investments from cloud service providers indicate a strong belief in the staying power of AI technology. While consumers may not fully embrace AI in their daily lives yet, the corporate world is making substantial moves to integrate it into their operations.

The recent downturn in industrial production and economic concerns in certain sectors might paint a bleak picture of the Chinese economy, but Nvidia's earnings hint at a different trajectory. The company's earnings report demonstrates the transformative role of AI in various industries, including cloud services, software development, and data analytics.

Key Takeaways:

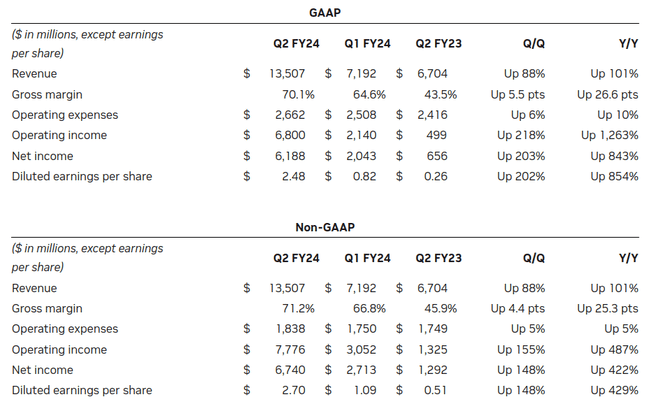

1. **Nvidia's Strong Earnings Performance:** Nvidia's latest earnings report showcases impressive results, signaling the company's substantial growth in the AI and cloud computing sectors. Despite the general perception that AI might not have a significant impact on consumers, cloud service providers are rapidly embracing the technology.

2. **Cloud Service Providers and AI:** Cloud service providers (CSPs), such as Amazon, Meta (formerly Facebook), Google, and Microsoft, are investing heavily in AI technology. These companies are utilizing AI to enhance their offerings, aiming to provide data-based insights and conclusions to customers across various industries.

3. **AI's Impact on Enterprise:** The Enterprise sector is experiencing a paradigm shift with the adoption of AI. Companies are replacing back-office jobs with AI-driven solutions, leading to increased efficiency and cost savings. The cloud service providers are the driving force behind this trend, recognizing the potential of AI to reshape various industries.

4. **Nvidia's Position in the Market:** Nvidia's success is evident in the demand for its AI hardware, such as the h100 and HDX platforms. Cloud service providers, as well as software companies like VMware, are increasingly relying on Nvidia's offerings to meet the growing demand for AI solutions.

5. **Sustainability of Demand:** Nvidia's executives have expressed confidence in the sustainability of AI demand for the next few years. The transition to cloud-based AI services is not a temporary trend; rather, it represents a long-term shift in how enterprises approach computing and data analytics.

While concerns about economic trends and consumer demand persist, Nvidia's earnings report suggests that the AI revolution is firmly underway, with cloud service providers leading the charge. The transformative potential of AI is undeniable, and as these technologies continue to evolve, they are likely to reshape the landscape of business and industry in the years to come.

So with all that good stuff, the expectation was that Nvidia’s sock would soar, similar to the Q1 earnings beat, when the stock went up more than 25%. Furthermore, with one of the most watched results publication, it was expected that blowout results would take the whole stock market, or at least the Nasdaq a few percent higher.

The initial reaction was good, with the stock trading 10% in the after hours market after the results were published. Then during the trading session the sentiment soured with the stock closing hardly in the plus and the market posting a negative performance.

We think the reasons are a combination of sell on the news, profit taking and last but not least, the Jackson Hole speeches of Lagarde and especially Powell today. Expectations are for some more hawkish soundbites.

Nevertheless, we believe that the Nvidia results have proven, that AI is real, and that the stock is a quasi-monopolist for the time being. We also believe that their guidance could be heavily sandbagged and that they are very likely to outperform set targets. In spite of a high (but a little less high, after the results) valuation, we believe the stock will perform well. No investment advice, of course.