China's Economic Challenges: Navigating Capital Flight, Industrial Struggles, and Global Implications

TLDR:

- China's economic challenges are evident in the midst of capital flight and industrial struggles, reflecting a complex economic landscape marked by trade imbalances, illicit capital outflows, and diminishing industrial production.

- Industrial production in China has notably declined across sectors like energy, infrastructure, transport, and consumer goods, with alarming figures including a 10% drop in consumer goods production and an 18% decrease in car sales.

- China's once-potent fiscal stimulus has encountered constraints, possibly due to a shift in priorities and a focus on financial security as part of national stability.

- Illicit capital flows challenge official statistics, with instances like a surge in precious stone imports from Hong Kong suggesting efforts to discreetly move assets out of the country.

- China's economic tribulations, encompassing industrial contraction and capital flight, have implications for global markets and international relations, calling for a delicate balance between economic growth, fiscal stability, and global influence.

China's economic landscape is showing clear signs of distress as two key issues - capital flight and industrial decline - come to the forefront. These challenges are emblematic of the nation's intricate economic situation, characterized by trade imbalances, illicit capital outflows, and declining industrial output. The implications of these challenges are far-reaching, impacting not only China's economic growth but also global markets and international relations.

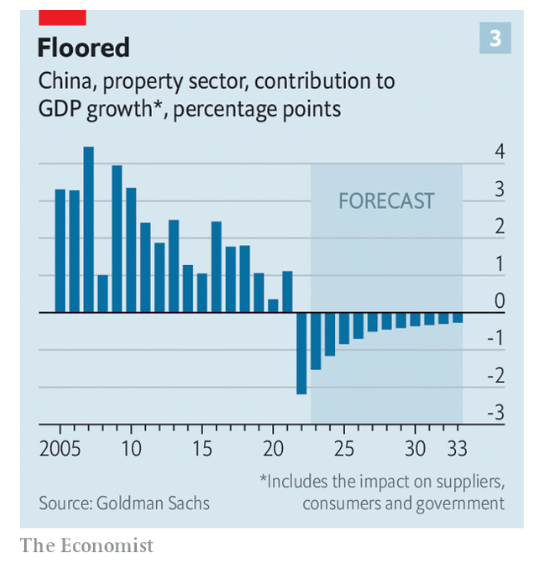

The downturn in industrial production is a prominent concern within China. Experts have observed a notable decline in various sectors such as energy, infrastructure, transport, consumer goods, and property. This downturn is exemplified by alarming statistics, including a significant 10% year-over-year decrease in consumer goods production and an unprecedented 18% drop in car sales - the sharpest decline in years. These figures indicate that China's economy has been contracting since as early as 2016, posing a threat to its overall fiscal momentum.

China's once-potent fiscal stimulus, which had been a driving force behind its robust economy, is now facing limitations. In previous years, China maintained a substantial fiscal deficit that amounted to 15% of its GDP - a figure that outpaced global norms. However, this fiscal push has waned in recent times, hinting at a potential shift in priorities. The country's inclination to safeguard its financial security in the context of national stability could underlie this transition.

A significant challenge arises from illicit capital flows that defy official records. An analysis of capital flows and currency turnover exposes a significant divergence, particularly during critical junctures like the 2015 yuan devaluation. Notably, the import of precious stones like diamonds and sapphires surged from 2.9% to 53% of China's total imports from Hong Kong within a few months. This suggests a concerted effort by certain entities to discreetly move assets out of the country using unconventional channels.

The behavior of affluent Chinese elites further underscores the gravity of these challenges. Their constrained international mobility and strategic asset relocation strategies indicate a concerted effort to secure wealth beyond China's borders. This trend potentially reflects China's leadership endeavoring to control ostentatious displays of affluence and shape global perceptions of their power.

Despite the appearance of stability in China's currency and official reserves, underlying economic indicators paint a more intricate and demanding picture. As economic trends persist, doubts emerge about the effectiveness of the government's measures to manage illicit capital flows, curb capital flight, and maintain domestic stability.

The confluence of China's economic tribulations, encompassing industrial contraction and capital flight, carries the potential to disrupt global markets and international relations in unforeseen ways. Striking a balance between economic expansion, fiscal stability, and global influence remains a central challenge for China's leadership.

Against the backdrop of escalating trade tensions and intricate currency dynamics, China's economic challenges assume a central role, potentially yielding far-reaching consequences for both domestic and global landscapes. The complex nature of these challenges is further complicated by the intricate interplay between trade imbalances, currency maneuvers, and diplomatic negotiations.

A pivotal facet of China's economic conundrum is its trade imbalance, which has garnered global policymakers' attention. Driven by a robust manufacturing sector and competitive exports, the nation's trade surplus has sparked debates. While some argue that China's trade practices are a result of its comparative advantage, others contend that currency manipulation and unfair trade tactics have distorted the global trade arena.

Currency dynamics form a critical lens for understanding China's economic challenges. The devaluation of the Chinese yuan (RMB) has not only captured global interest but has also fueled allegations of manipulation. Critics posit that China intentionally devalues its currency to gain export competitiveness and counter tariff impacts, raising questions about trade equity and the sustainability of China's economic model.

The ongoing trade negotiations between China and the United States, characterized by negotiations and deadlines, add another layer of complexity. The March 1st deadline for trade talks, while met with cautious optimism, introduces uncertainty into global markets. The potential deadlock on crucial issues like intellectual property theft, technology transfer, and trade practices underscores the intricacies of China's economic hurdles.

The broader global ramifications of China's economic challenges unfold in two ways. Firstly, given its role as a significant consumer and producer, the health of China's economy profoundly affects global growth. A deceleration in China's growth could reverberate through global supply chains and detrimentally impact economies heavily reliant on Chinese exports.

Secondly, the interconnectivity of global financial markets implies that China's economic challenges can trigger ripples across borders. Concerns about capital flight, currency devaluation, and market instability have the potential to spill into other economies. Moreover, perceptions about China's economic stability can sway investor sentiment and wield broader implications for market confidence.

Within this intricate tapestry of economic challenges, attaining a balanced resolution is of paramount importance. Whether through diplomatic dialogues, policy overhauls, or collaborative initiatives, addressing China's economic complexities demands meticulous consideration of its multifaceted nature. As global leaders grapple with these complexities, the outcomes will inevitably shape the trajectory of the world economy and the dynamics of international interactions.