The year 2024 is poised to mark a pivotal milestone for cryptocurrencies, particularly in the United States, with the highly anticipated introduction of an Exchange-Traded Fund (ETF) based on Bitcoin as its underlying asset. So far, all attempts by asset managers to introduce such an ETF have been rejected by the U.S. financial regulator, the SEC. However, approval seems imminent now.

What impact does this introduction have on Bitcoin's price?

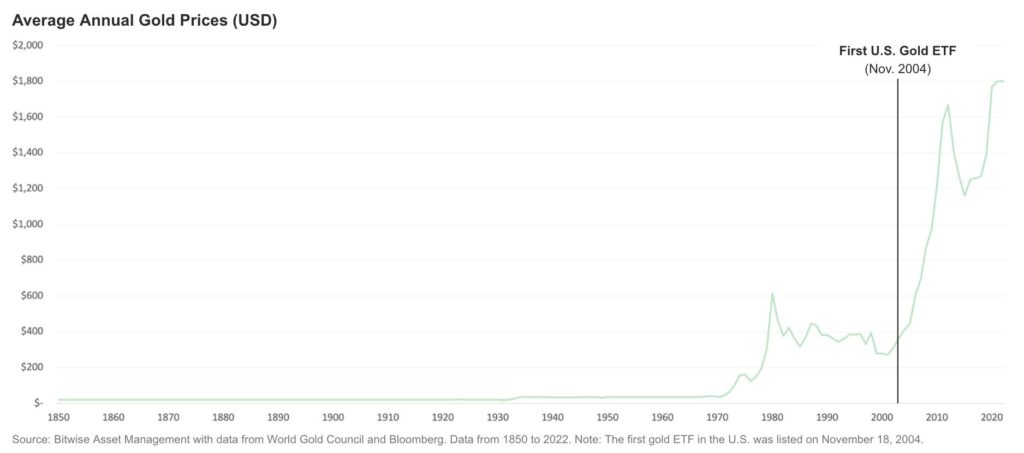

This ETF could have a significant impact on the entire crypto sector. The primary advantage lies in simplified access to Bitcoin investments, bypassing the hassle of setting up specialized accounts on a Bitcoin exchange and storing digital assets. Comparable to the introduction of the first gold ETF, which made gold accessible to every investor, this could have a similar effect on Bitcoin. After the launch of the gold ETF, the price of gold significantly surged due to increased demand facilitated by improved accessibility. Bitcoin investors anticipate a comparable effect. An intriguing dynamic arises due to the limited supply of available Bitcoins. If asset managers succeed in attracting investors to the Bitcoin ETF, this could result in a strong surge in demand against limited supply, potentially driving the price upwards. However, as is common with major news announcements, there's a risk of a short-term "sell-off" post-ETF approval.

When will these products hit the market?

Expectations point toward approval occurring in the coming days or possibly by early March. Currently, 13 applications are on standby, likely to be approved simultaneously. Major asset managers like BlackRock, Fidelity, and Franklin are gearing up to enter the crypto market and swiftly establish dominant positions. Post-approval, these managers will initiate intensive marketing campaigns to gain market share.

What follows post-introduction?

Yet, this marks just the beginning. Applications for ETFs based on the Ethereum cryptocurrency are already in line. If the Bitcoin ETF proves successful, approvals for these applications might quickly follow suit. This signals a growing interconnectedness between the crypto and traditional financial worlds.

The crypto realm has predominantly attracted adventurous investors willing to take risks and navigate complex investment paths. However, for traditional asset managers, the world of cryptocurrencies presents uncharted territory offering lucrative management fee revenues in a rapidly growing sector. Their involvement could simplify access for all to invest in this new asset class, potentially resulting in significant and rapid growth in market capitalization within this hitherto relatively niche sector.

The first Bitcoin commercials are live!