In the world of alternative investments, where traditional avenues can often feel crowded and stagnant, enterprising investors are constantly on the lookout for unique and lucrative opportunities. One such opportunity that has gained considerable attention in recent years is investing in whisky. While not every bottle of whisky is a potential goldmine, the allure of closed distilleries and aged casks has transformed this spirit into a liquid asset with the potential for impressive returns.

Whisky, a distilled alcoholic beverage made from fermented grain mash, has experienced a renaissance of sorts in recent times. Previously relegated to enthusiasts and connoisseurs, it has now captivated the attention of investors seeking diversification and appreciation potential beyond traditional stocks and bonds. The appeal of whisky investment lies in its combination of history, craftsmanship, and scarcity.

It's essential to distinguish between investing in whisky and merely collecting it. Not every bottle of whisky is suitable for investment purposes. While certain limited edition releases from renowned distilleries can appreciate in value over time, the real investment potential often lies in closed distilleries and aged casks.

Closed distilleries represent a treasure trove for whisky investors. These are distilleries that, for various reasons, have ceased production, rendering their existing stocks finite. As the years go by and available bottles dwindle, the demand for these increasingly rare whiskies tends to rise, driving up their market value. A prime example is the Port Ellen distillery, which ceased production in 1983. Bottles from this distillery have seen astronomical price increases over the years, making them highly sought after by investors and collectors alike.

For instance, the Karuizawa distillery, situated in Japan, is another illustrious example of a closed distillery that has become a sensation in the world of whisky investment. Its limited production and unique flavors have elevated its value over the years. Similarly, the Hanyu distillery, also in Japan, garnered immense interest due to its closed status, resulting in a surge in the value of its remaining bottles.

Investing in aged casks of whisky is a more indirect yet potentially lucrative avenue. As whisky ages in oak casks, it undergoes complex chemical reactions that impart unique flavors and characteristics. This maturation process also translates into increased value over time. Savvy investors often purchase casks of new-make spirit from established distilleries, allowing them to benefit from the compound appreciation as the whisky matures.

The investment performance of whisky is a compelling reason for its growing popularity in financial circles. While precise performance figures can vary widely based on factors such as distillery reputation, age, rarity, and market trends, historical data reveals impressive returns. Some closed distillery bottles have appreciated by over 1,000% over the course of a few decades, outperforming traditional investments in equities and real estate.

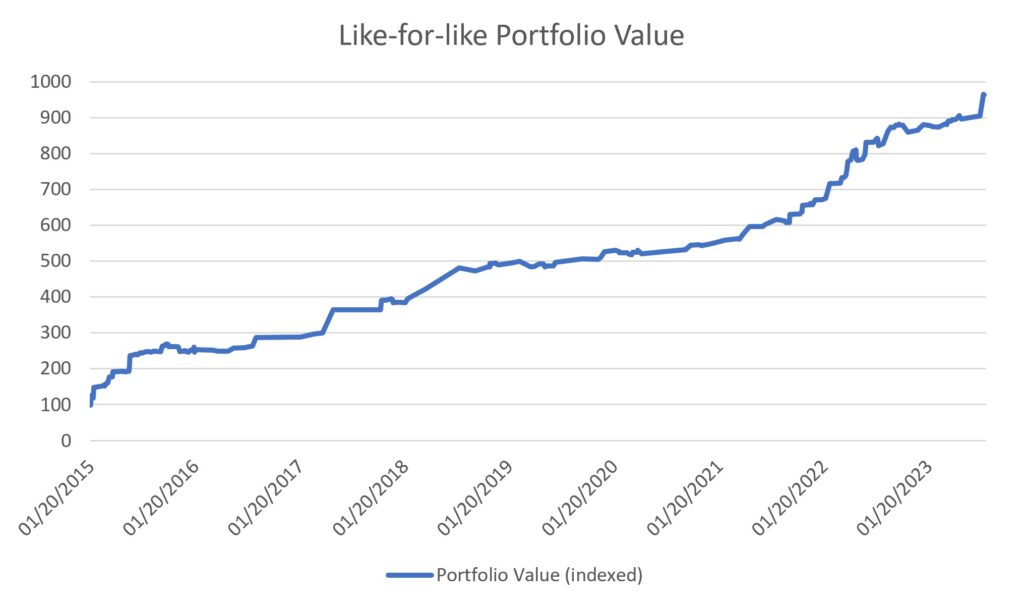

The author of this article has a modest collection of rare whiskies as well. Starting in 2015, the like-for-like performance of the collection of Scottish and especially Japanese whiskies has shown a solid performance, especially on a risk-adjusted basis. The total return from 2015 to 2023 YTD stands at 964%, or 46.6% annualized. Annual volatility is only 6.6%. Obviously, pricing of such an illiquid liquid asset is not easy. Collector websites like whiskybase.com, where you can set up your portfolio, take prices from different sources like online dealers or auction websites. Prices sometimes are asking prices, and real transaction prices might be a full third lower than what's being asked. Yet what matters is not the absolute level, but the return development. Hypothesizing that the discount to asking prices is relatively stable over time (in the author's view, much more stable than, for instance, the differential between house prices and transaction prices), the return numbers should be little affected.

As with any investment, there are factors to consider before diving into the world of whisky investment:

1. **Expertise**: Developing an understanding of whisky production, distilleries, and market trends is crucial. Enlisting the assistance of experts or joining whisky investment groups can provide valuable insights.

2. **Authenticity**: Counterfeit whisky is a concern in the investment world. Ensuring the authenticity of bottles or casks through rigorous authentication processes is essential.

3. **Diversification**: Just as with any investment portfolio, diversification is key. Investing solely in whisky carries risks, so it's advisable to incorporate whisky investments into a broader investment strategy.

4. **Market Trends**: Monitoring market trends and shifts in consumer preferences is important to anticipate potential shifts in the value of different types of whisky.

5. **Time Horizon**: Whisky investment is typically a long-term endeavor. Investors should be prepared to hold their assets for years to fully capitalize on appreciation.

Investing in whisky, particularly closed distilleries and aged casks, offers a unique and potentially rewarding avenue for investors looking beyond traditional assets. The allure of rarity, coupled with the undeniable charm of a spirit that carries within it the essence of history and craftsmanship, makes whisky investment an enticing proposition. With examples like Karuizawa, Hanyu, Port Ellen, and Brora, the world of whisky investment presents a tantalizing blend of history, connoisseurship, and financial opportunity.

As with any investment, thorough research, careful consideration, and a long-term perspective are key to raising a glass to success in this unconventional market. As you venture into the realm of whisky investment, you're not just acquiring a liquid asset; you're immersing yourself in a world of flavor, heritage, and potential returns. So, whether you're a seasoned investor or a curious enthusiast, the realm of whisky investment invites you to savor not only the taste but also the rewards of a well-made investment.

I think the key skill set needed for investing in Whiskey is the discipline not to drink it! 😉