A very long time ago, we had the privilege of attending a session with futurist Raymond Kurzweil. He introduced us to the concept of exponential thinking and exponential technologies. Exponential innovations that accelerate at an unprecedented pace and simultaneously drive down costs. Think of AI, Robotics, and Nanotechnology, for instance. Kurzweil's message was clear: while people tend to think linearly, the impact of technology unfolds exponentially. This revelation sparked a significant shift in our investment philosophy. We began focusing more on high-growth secular technology trends and hunting for high-quality companies poised to exploit these opportunities. One such example is NVIDIA (NVDA), a company we invested in nearly a decade ago. We recognized how NVDA was strategically positioned to ride multiple secular exponential growth trends in gaming, self-driving cars, cloud services (data centers), AI, and VR. Our takeaway from Kurzweil's presentation? Embrace an exponential mindset. Since then, we've continued to scour the investment landscape with an exponential thinking mindset. Our journey led us to discover opportunities in sectors like cybersecurity and robotics. But even in more traditional equity sectors, we've unearthed opportunities. Take real estate, for instance. We recognized early on the potential in logistics exposure profiting from exponentially growing technology, a move that allowed us to outperform the performance of other real estate companies.

Investing in exponential technology can be both lucrative and perilous. The landscape is brimming with negative cash flow companies, innovations that may never reach mass production, and technologies susceptible to disruption. A weak balance sheet can spell disaster. We've honed our selection process to be extremely discerning, steering clear of science fiction notions that may never materialize. We seek quality, robust potential cash flow growth, high ROE, strong management teams, and tech leadership. Investing in such companies simplifies our lives as we ride the wave of exponential trends.

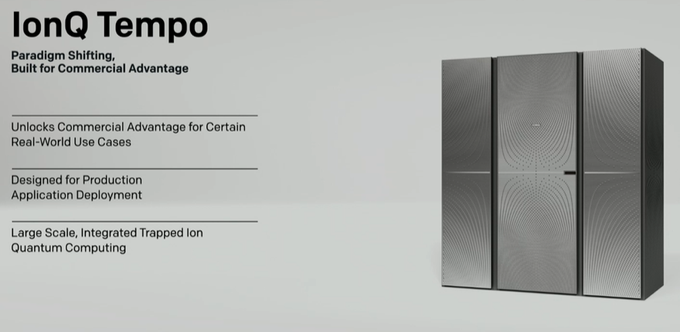

In recent years, our quest led us to explore the quantum computing (QC) sector. Quantum computing, with its foundation in the mind-bending principles of quantum mechanics, offers solutions to problems that classical computers can't crack. Quantum computing could be a game-changer in AI, healthcare, and self-driving cars. The processing power of QC has the potential to ignite a new era of computing applications in areas where computational limitations currently hold us back. While giants like IBM and Google have made strides in QC, it's not easy for investors to gain focused exposure to this theme. Enter IONQ, a company we started following 18 months ago. IONQ, a recent entrant to the public markets with a strong balance sheet, aims to develop quantum computers capable of solving real-world problems and making them accessible to a broader audience. What sets IONQ apart is its tangible progress toward quantum computer production and commercialization. This progress compels us to shift our focus from conceptualizing quantum computers to exploring the added value applications they can offer. We believe the hardware development phase is nearing completion, with the spotlight now on software. Software is the critical layer that will harness this technology and unlock new opportunities for the world. IONQ is close to commercially offering quantum computing to the market and is ready for pre-orders. If they succeed this company will experience extremely rapid growth, turning into a profitable cash flow-positive company.

With the delivery of rack-mounted AQ64 systems scheduled for 2025 and available for order today, IONQ is making strides that could position them as the frontrunners in this nascent industry. We believe the first mover takes all. Their track record, talented team, and robust financial standing are notable strengths. However, the quantum computing race is high-stakes; competition may introduce superior technology, and IONQ must deliver on its milestones. To be clear, IONQ is currently a high-risk investment. Yet, we see quantum computing no longer as a technology of the distant future but it might be at the stage of a pivotal force in tomorrow's world.

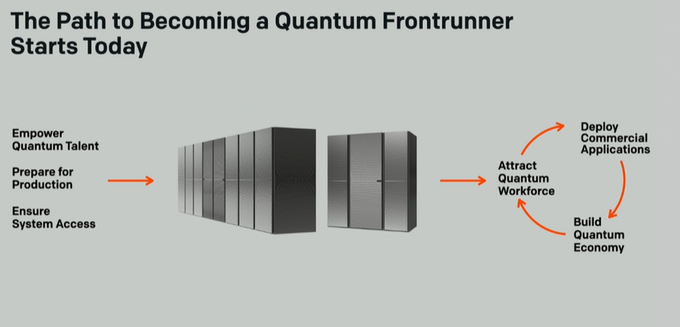

IONQ describes its strategy as a self-reinforcing wheel, and we're eagerly watching as this wheel propels us toward an exciting future.

Disclaimer: We currently hold a position in IONQ, and we may consider increasing our exposure if the company successfully achieves its targets.

Who is Ray Kurzweil: Ray Kurzweil is a leading proponent of exponential thinking. He believes that the pace of technological progress is accelerating at an exponential rate and that this will have a profound impact on society. Kurzweil has coined the term "the law of accelerating returns" to describe this phenomenon. He argues that the rate of technological progress is increasing exponentially. Kurzweil believes that these technological breakthroughs will have a positive impact on society and that they will lead to a new era of peace and prosperity.