In recent months, we have witnessed a consistent uptick in the yield of the 10-year U.S. Treasury bonds (UST10Y). Initially, financial markets appeared relatively unfazed by this development, as major corporations had secured favorable interest rates in the past, and the Federal Reserve (FED) was injecting liquidity into banks through its bank term funding program. However, as the yield has continued to surge, we are now nearing the critical 5% threshold. The market appeared complacent in the face of this upward trend, allowing the yield to break out, leading to an even steeper ascent. Additionally, the previously observed inverted yield curve is disappearing due to the substantial rise in long-term maturity yields. Are we witnessing an uncontrolled surge in long-term maturity yields?

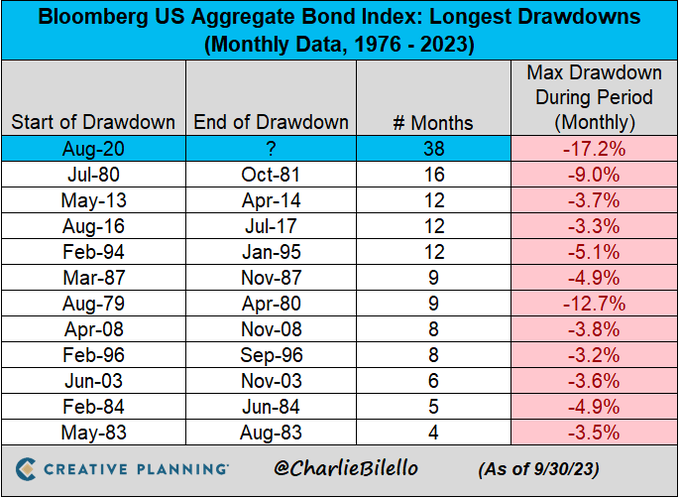

This year marks the third consecutive year of negative returns in the bond markets, a situation that is historically unprecedented.

Jack Farley recently shared a remarkable chart on x.com (@JackFarley96). The chart illustrates that ultra-long-duration Treasury bonds have lost a greater percentage of their value than U.S. stocks did during the financial crisis 16 years ago. The suffering of bondholders seems unending, and it raises questions about who is bearing the brunt. As mentioned earlier, major corporations have secured favorable interest rates and are yet to feel the pain. However, smaller companies with limited funding options and so-called zombie companies must be feeling the strain. U.S. banks are benefiting from the FED's liquidity program, effectively transferring the liability onto their books. This leads us to wonder where the pain is accumulating. It's likely that certain mature pension funds might struggle and fail to meet their pension payment obligations. Could there be a mismatch?

Globally, there must be other pockets of distress. A significant portion of loans are denominated in USD, and some lenders may find themselves scrambling for USD to cover interest payments. We believe that the robust USD and the rapid surge in interest rates could be exerting pressure on the credit system. The overall value of global bonds is diminishing, and the diminishing global collateral base poses an exceptionally perilous situation for financial markets.

@Schuldensuehner

The U.S. dollar has demonstrated remarkable strength due to heightened demand for the reserve currency. This is causing issues worldwide. The Chinese economy requires stimulus from the People's Bank of China (PoBC), but they are cautious about allowing the CNY to weaken past the 7.30 level. It appears they are striving to strike a balance between supporting their economy through stimulus while preventing excessive depreciation of their currency. Meanwhile, other central banks have maintained their composure. Nevertheless, given the current momentum in interest rates and the strength of the USD, we believe we are approaching levels where more central banks may need to take action.

This scenario is unfolding as anticipated. Today, we expect that the Bank of Japan (BoJ) will convey its intention to prevent further weakening of the JPY. The BoJ is likely contemplating the need to signal to the market that a weaker JPY should not be speculated upon. High long-term yields and an appreciating JPY could disrupt carry trades and exert further upward pressure on U.S. treasuries yields. With two central banks now intervening in the markets to maintain control, our attention returns to the Western hemisphere.

The U.S. government's debt maturity profile reveals that, in addition to its sizable deficit, it must raise a substantial amount of capital. At a certain threshold, the U.S. government may find it increasingly challenging to service its interest obligations.

We observe a rising systemic risk and a gradual erosion of market liquidity. Our concerns extend to banks, real estate markets, Asian and emerging markets, the European crisis, and overall market liquidity. With the treasury yield nearing 5% and two central banks actively participating in the markets, we believe a coordinated approach by central banks is needed. Unfortunately, given the current tensions between the U.S. and China, this may not be feasible at the moment. Nevertheless, we posit that the market will increasingly turn its attention to the FED and address the risks inherent in the current environment. Central banks will certainly intervene when a crisis becomes imminent, which could happen at any moment. The question that remains is whether it is wiser to act proactively now to manage the damage or attempt to rescue a market that could implode in the future.

In a nutshell: Yields are going up because governments need to borrow more than planned, driven by higher interest costs due to increased yields, and they plan to significant borrow more. This cycle keeps pushing yields higher, potentially leading to a financial crisis. They need lower yields to break free. They need lower yields to break free. We think all roads lead to intervention.

In part 3 of this trilogy, we will focus on investment opportunities, given this background.