Quantum computing has been gaining significant attention recently, driven by several key factors:

- Progress in Quantum Research: Advances in quantum technology are being recognized globally.

- National Interest: Governments around the world are classifying quantum computing activities as matters of national interest.

- Military Interest: There's substantial interest from the military in quantum networking for secure communications.

- Political Influence: The anticipation around a new Trump administration has spurred discussions on technology promotion, often termed as the "Trumppump".

Additionally, Google made headlines with the announcement of their new quantum computer, "Willow", claiming that by adding more qubits, noise could be reduced in their lab experiments. While this was heralded as revolutionary, it primarily showcases the ongoing progress in quantum research using superconducting technology, which, however, has yet to translate into practical applications. Quantum computing remains in its early phase, with much still to be discovered about its practical utility.

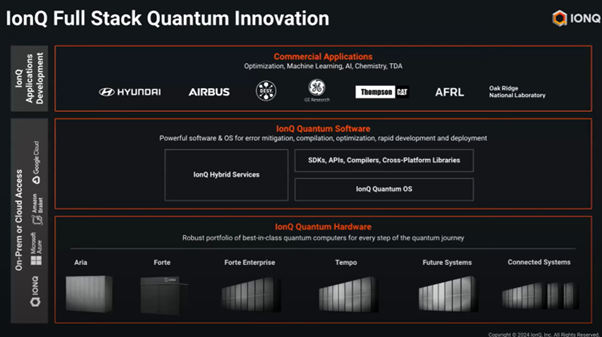

For readers of this blog, our favoured quantum stock is IONQ (click here for our previous blogpost in IONQ). Unlike many quantum projects, IONQ's mission is to develop quantum computers ready for commercial use, not just lab experiments. IONQ is working on real applications with real partners and clients in contrast to lab experiments.

IONQ has many key advantages over the competition:

- Trapped Ion Technology: Offers high fidelity and connectivity for more efficient quantum operations.

- Commercial Advantage: Focuses on practical benefits over theoretical supremacy, targeting real-world applications.

- Enterprise Solutions: Scalable, enterprise-ready quantum systems with a hybrid services suite.

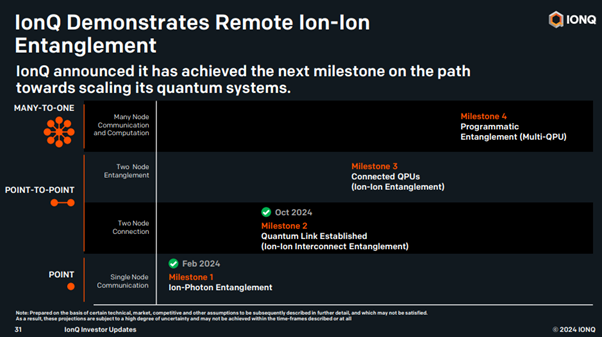

- Modular Architecture: Enables scalable quantum networking for complex computations.

- Error Correction: Advances in reducing errors with new ion technologies.

- Strategic Alliances: Partnerships with major cloud providers increase accessibility.

- Innovation: Strong patent portfolio in quantum control and operations.

- Strong Balance Sheet: Robust financial health supports ongoing R&D and market expansion.

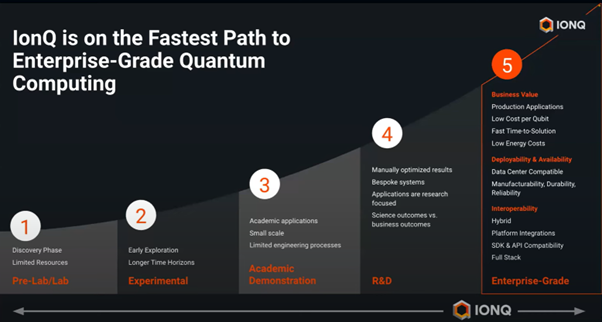

IONQ has shifted its focus to phase five creating business value and ready to deploy in hybrid configurations in normal data centers.

They have achieved series production capabilities with their new factory, launched an upgraded quantum computing (QC) operating system, and offer various software packages tailored to different sectors. This approach mirrors NVIDIA's (NVDA) successful GPU strategy, providing both hardware and cloud access alongside sector-specific software modules.

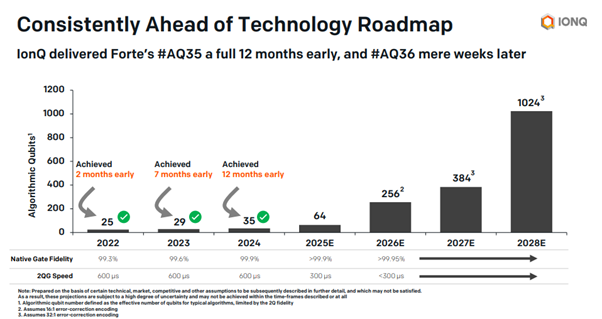

IONQ is poised to announce #AQ64, which is when quantum computing applications will exceed the simulation capabilities of traditional datacentres. Post-#AQ64, IONQ plans to rapidly scale quantum computing to new dimensions, focusing on practical applications rather than just theoretical advancements. The upcoming TEMPO systems (AQ64) are under close watch for market uptake, which will largely depend on partnerships with entities like the U.S. military, AstraZeneca, Airbus, Thomson Machinery, and Hyundai. Initial buyers are expected to be government agencies and research institutions, with hyperscalers likely to follow.

IONQ is not stopping there! They're also delving into quantum networking through acquisitions. Quantum networking promises ultra-secure communication via quantum entanglement and teleportation, offering potential advantages in speed and security over traditional networks. This technology will help IONQ to scale its quantum computers, but certainly this technology is particularly appealing to the military for its unbreakable communication channels. This is probably why they announced a contract award with the US Airforce research lab.

IONQ's recent progress has caught the market's eye, reflected by its strong performance. However, the quantum computing sector is fraught with risk as none of these companies are currently profitable. Innovation could disrupt existing initiatives, but IONQ's first-mover advantage might cement its leading position.

Market valuations seem to price in significant revenue growth for 2025, suggesting that without further announcements, IONQ might not be considered a 'cheap' investment. We are invested with a long-term horizon of 5+ years, focusing more on the potential than trading current market pricing. If you align with the IONQ thesis, there might be better entry points in the future.

Disclaimer: we are long IONQ