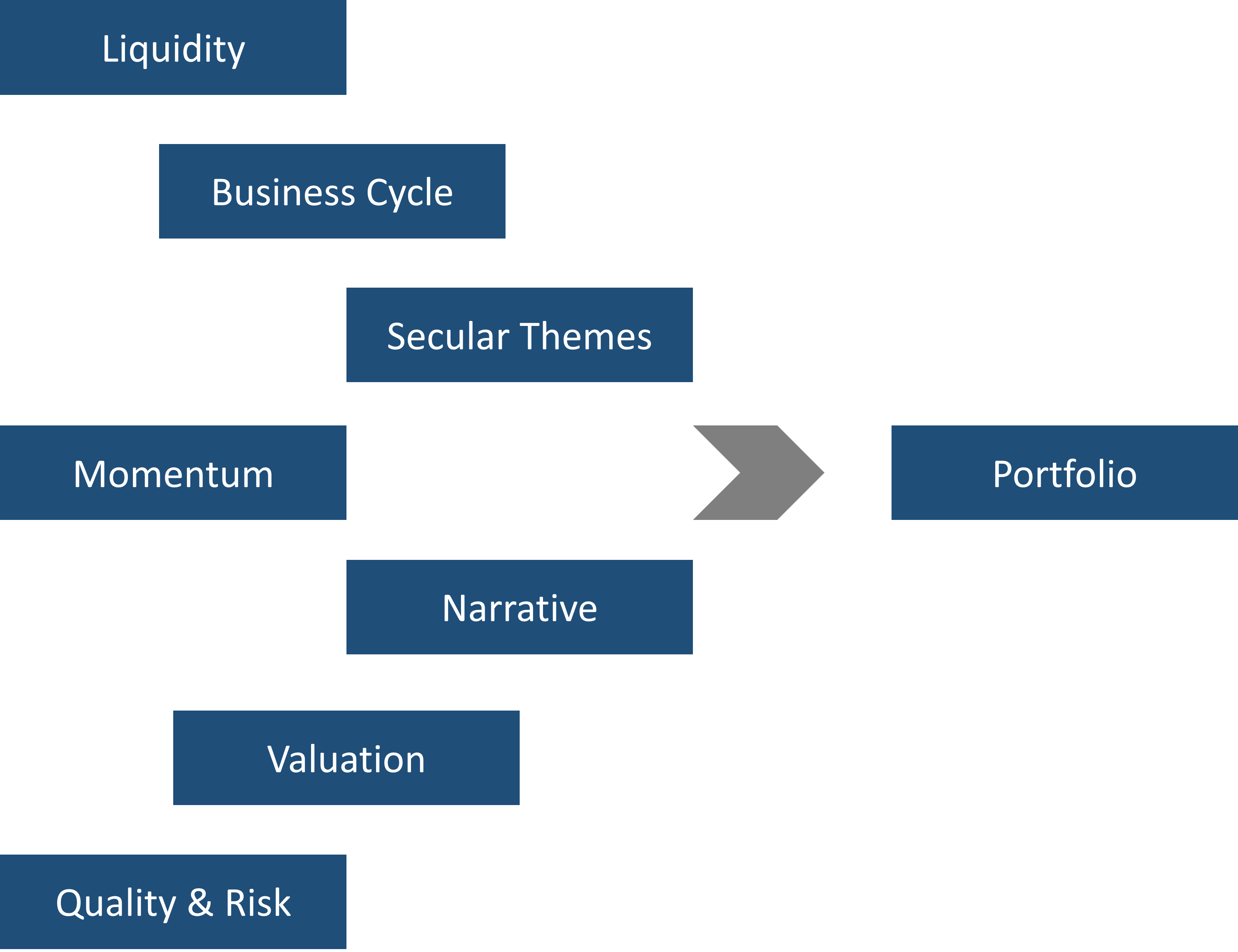

Our Investment Framework

Colorful Citizens Capital executes a structured approach to investing that takes into account several important factors that can influence investment performance. We use an iterative process because these factors can be interrelated, and we want to make informed decisions that align with our clients' goals and risk tolerance.

One factor we pay attention to is liquidity, which refers to the availability of money and credit in the market. We believe that understanding the state of liquidity is crucial for driving market momentum. For example, since 2008, central banks have executed various liquidity programs that have significantly impacted asset pricing. By focusing on liquidity indicators like the rate of change of the size of central bank balance sheets, we can gain insight into market trends.

We also analyze the business cycle, which refers to the fluctuations in economic activity over time. Knowing where we are in the cycle can help us make investment decisions about which sectors or asset classes to focus on. For example, during an economic expansion, technology and consumer discretionary stocks may perform well, while during a recession, utilities and consumer staples may be better options. We use indicators like the ISM to help us gauge the state of the business cycle.

We also pay attention to secular themes, which are long-term trends that can drive growth in certain sectors or industries. Examples of secular themes include renewable energy, digital transformation, and healthcare innovation. Investing in companies that are aligned with these themes can offer opportunities for long-term growth, so we look for these trends early on to capitalize on market growth.

When we're considering an investment, we also analyze the quality and risk factors associated with it. This includes looking at factors such as financial health, management quality, and competitive advantages. We believe that quality has a price and that it's essential to understand both the quality and risk of an investment before committing capital.

Valuation is also an important factor, as we need to understand the price of an asset relative to its underlying fundamentals. Depending on the asset class, we use different valuation techniques. We like to analyze absolute sector valuation and focus on relative valuation for single investments.

We also pay attention to the narrative surrounding an investment. This includes scenario analysis, asset class analysis, and sector analysis. Understanding the narrative is essential for successful investing.

Lastly, we use technical indicators to help us find the right timing to execute our trades. While we focus on mid to long-term investments, we also enjoy active trading.

Overall, our investment process is comprehensive and covers the important factors that can drive investment performance. We believe that a disciplined approach to investing, like the one we use, can help us make informed decisions that align with our clients' goals and risk tolerance.